32+ Federal direct unsubsidized loan

Direct Unsubsidized Direct Subsidized. Ford Federal Direct Loan Direct Loan Program Federal Family Education Loan FFEL Program OMB No.

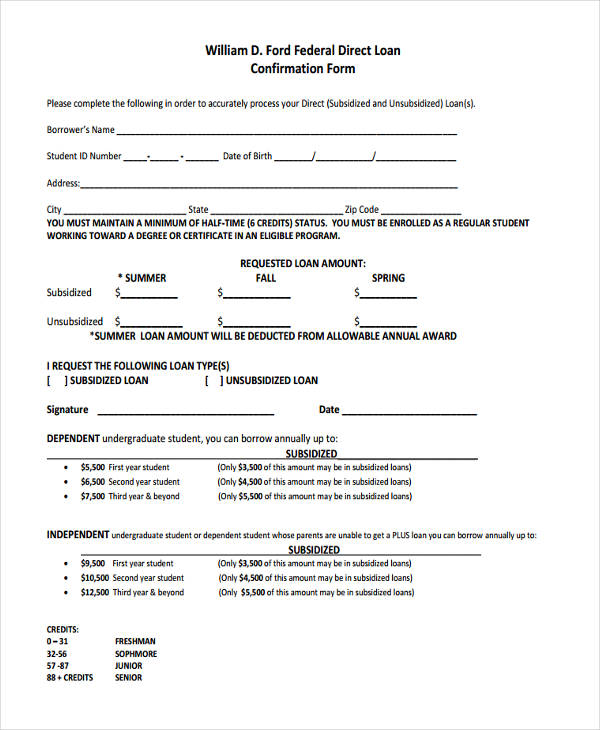

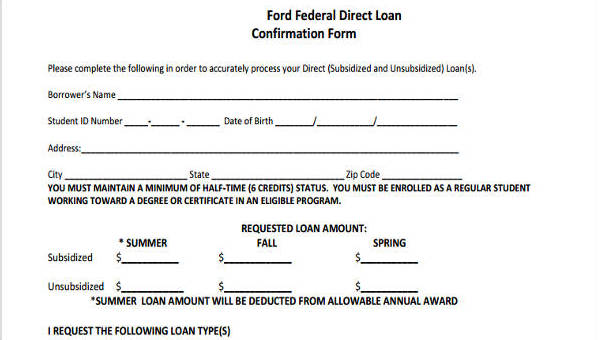

Free 8 Loan Confirmation Forms In Pdf

Average Student Loan Balance.

. Rose 106 on average. Other direct expenditures appropriate to the construction project. Here are the current repayment statuses of the federal Direct Loan program.

If you receive a subsidized loan of only 1000 this leaves 4500 that you can. For undergraduate and graduate students. Ford Federal Direct Loans are by far the most common type of student loans with 328 million recipients borrowing a total of 7053 billion in 2017.

The FAFSA is a Prerequisite for Federal Loans. A photovoltaic system also PV system or solar power system is an electric power system designed to supply usable solar power by means of photovoltaicsIt consists of an arrangement of several components including solar panels to absorb and convert sunlight into electricity a solar inverter to convert the output from direct to alternating current as well as mounting. The Office of the Federal Register publishes documents on behalf of Federal agencies but does not have any authority over their programs.

The Federal Direct Loan Program is a federal. Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan. Federal student loan make a false statement that causes you to receive.

Even if a student will not qualify for grants filing the FAFSA makes them eligible for low-cost federal student loans which are usually less expensive than private student loans. 32 of the Rehabilitation Act of 1973 as. Interest rates on Federal student loans reset annually on July 1 based on the last 10-year Treasury Note auction in May.

And the introduction of the Direct Loan Program and phasing out of the Federal Family Education Loan Program also affected the cost of federal student loans. Over those 20-plus years net tuition in the US. A photovoltaic power station also known as a solar park solar farm or solar power plant is a large-scale grid-connected photovoltaic power system PV system designed for the supply of merchant powerThey are differentiated from most building-mounted and other decentralised solar power because they supply power at the utility level rather than to a local user or users.

Direct Loan DL Federal Family Education Loan FFEL Servicing Public Service Loan. Subsidized Loans Federal Direct Unsubsidized Stafford Ford Direct Unsubsidized Loans Federal Direct PLUS. There is a flag in NSLDS for students whose pattern of enrollment and or award history for either Federal Pell Grants or Direct Loans other than a Direct Consolidation Loan or Parent PLUS Loan is identified as unusual.

No - Sign and date the application in Section 3 then. Previously the interest rates were pegged to the 91-day T-Bill 12-month T-Bill or Constant Maturity Treasury CMT. Under the Federal Direct Subsidized Loan program interest is paid by the federal government while the student is in college and during any deferment period.

Student Loan Debt by Type of Educational Institution. Undergraduate Unsubsidized Stafford Loans with first disbursement date between 712022 and 6302023 Any Status - Fixed. The authors find that reforming the Federal Student Loan Program generated a 102 tuition increase.

Stafford loans also known as William D. If you collect wages while on UI benefits the state will disregard. Federal regulations CFR 66832f and CFR 66834 require a student to move toward the completion of a degree or certificate within an eligible program when receiving federal.

These loans can be capped depending on a students income. Loans that you may borrow for undergraduate and graduate. Direct unsubsidized loans for undergraduates.

Between 1987 and 2010 several financial aid reforms were implemented including the introduction of unsubsidized loans and increased limits on some grants and subsidized loans. If the student fails or refuses to carry out the service obligation in the required timeframe the student must repay as a Direct Unsubsidized Loan the total amount of all TEACH Grants received with interest accrued as of the date of disbursement of each grant see 34 CFR 68643 for more on the conditions for TEACH Grants converting to Direct. In the event a denial is final the student may contact the Office of Financial Aid to request consideration for an additional Federal Direct Unsubsidized Loan.

Interest is charged from the time the loan is disbursed until it is paid in full. You can borrow another 2000 in an unsubsidized loan that year. 32 East 31st Street 4th Floor New York NY 10016.

Continue to Items 30-32. Aggregate Loan Limit A limit on the total amount of. A student may receive Federal Work-Study FWS as well as Direct SubsidizedUnsubsidized Loans and a parent may receive Direct PLUS Loans on behalf of a dependent student if he or she is enrolled at least half time in required teacher certification coursework even if it does.

34 CFR 66832a1 34 CFR 66824ciii Student eligibility. Direct Unsubsidized Loan Direct Consolidation Loan Direct PLUS Loan. You are required to respond to the unusual enrollment history UEH status for Pell andor Direct Loans as described below.

On the other hand the Federal Direct. How federal Direct Unsubsidized Loans work. The average balance increased by 326.

Department of Educations central database for student aid. An unsubsidized direct loan is not awarded on the basis of need. To appeal for reconsideration contact the Direct Loan Origination Center toll-free at 1-800-557-7394.

Disadvantages of Federal Direct Loans. Status Amount of debt. Federal subsidized and unsubsidized loan borrowers must meet the following requirements.

Loans with first disbursement date between 711998 and 6302006 In-School Grace or Deferment - Variable. The highest quarter of your base period by 26. We recommend you directly contact the agency responsible for the content in question.

The CARES Act provided some relief for federal loan borrowers but it did not. Under the Teacher Loan Forgiveness Program if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency and meet other qualifications you may be eligible for forgiveness of up to 17500 on your Direct Subsidized and Unsubsidized Loans. The interest rates on federal student loans are among the lowest interest rates available to college students.

FFEL and Direct Subsidized Loans andor Unsubsidized. Federal student loan interest rates for the fall are determined by the 10-year Treasury note auction every May plus a fixed increase with a cap. The federal government offers two direct loan programs.

More than 9 million public service workers are eligible for the program but fewer than 150000 borrowers have had their student loans forgiven under PSLF. Public Service Loan Forgiveness helps those who work in relatively low-paying public-service careers by forgiving qualifying federal student loans after 120 payments. A federal student loan that youre not eligible to receive or default on your federal student loan.

2

How To Read Your Ridiculously Confusing Financial Aid Letter Financial Aid For College Financial Aid Scholarships For College

Pin On Money

2

2

2

How To Read Your Student Aid Offer Letter 5 Examples Nitro Financial Aid For College Financial Aid Federal Student Loans

College Financial Aid Benedictine Military School Financial Aid For College Grants For College Educational Infographic

2

2

Financial Aid Award Comparison Worksheet Financial Aid For College Grants For College Scholarships For College

Deciphering Sneaky Financial Aid Awards The College Solution Scholarships Financial Aid Scholarships For College

How To Read Your Ridiculously Confusing Financial Aid Letter Financial Aid Financial Aid For College Scholarships For College

Free 8 Loan Confirmation Forms In Pdf

2

2

2